You may have heard the terms cash basis of accounting and accrual basis of accounting but what do these terms mean? Depending on your goals for your business and your tax filing requirements, it is important to understand the difference between the two to determine how you should prepare your financial records.

Differences between cash basis of accounting and accrual basis of accounting?

- Cash basis: revenue and expenses are recorded when they are paid.

- Accrual basis: revenue and expenses are recorded when they are incurred.

Why is it important?

Business owners may have a choice between whether they want to report their financial numbers under the accrual basis or the cash basis depending on a variety of factors. However, some businesses are required to use the accrual basis of accounting. Speak with your tax preparer to determine if you are required to file using the accrual method of accounting or contact us for a consultation.

Advantages of the cash method of accounting

- Ease and simplicity of accounting → Business owners can spend less time doing bookkeeping and accounting work, or less money if they outsource their accounting tasks.

- Potentially lower tax bill → If you are paying for expenses in advance, under the cash basis, the entire expense is recognized when paid, whereas under the accrual method, a prepayment should be expensed over all future periods in which the prepayment relates to.

Advantages of the accrual method of accounting

- Accuracy of financial records will help you to better understand how your business is performing so you can make changes based on your financial results.

- Some banks may request that financial reports be prepared under the accrual basis of accounting to qualify your business for a loan.

- For business owners looking to sell their business, investors may prefer that your financials are reported using the accrual basis to assure that you are providing accurate and relevant financial information.

Examples

Revenue and expense recognition

XYZ Marketing does consulting work for its clients and bills the client for $700 once each project is complete. XYZ finishes a project for their client ABC Boutique on December 27th, 2022, but ABC does not pay the bill until January 5th, 2023.

Under the cash basis of accounting, the revenue is recognized once the cash is received. The entry would be booked as follows:

Note that the date of the entry is the date that the cash was received from the client. This is important because in this case, the revenue was recognized in January of 2023.

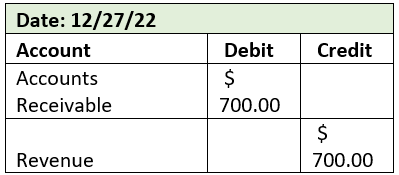

Under the accrual basis of accounting, the revenue is recognized when the work is complete. XYZ completed the work and billed the client on December 27th, 2022. As such, the entries would be recorded as follows:

Under the accrual method, the date that the revenue was recorded was in December of 2022. In this case, the revenue will be recognized in 2022 because that is when the work was completed by XYZ.

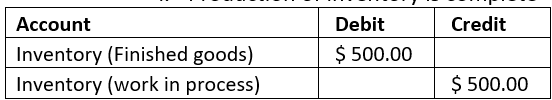

Inventory

The nature of tracking inventory requires it to be tracked on an accrual basis. However, a company can still file using the modified cash-basis accounting if it owns inventory but wants to record other entries using the cash basis.

Here is a trail of entries showing how $500 of inventory should be recorded from start to finish:

Prepaid Expenses

Prepaid expenses are recorded for payments that were made in advance for goods or services that will be received or incurred at a future date. Prepaid expenses are classified as assets on the balance sheet and are expensed over the period they are incurred. Prepaid expenses should not be booked under the cash basis of accounting because under the cash basis, the expense would be recognized on the date it is paid.

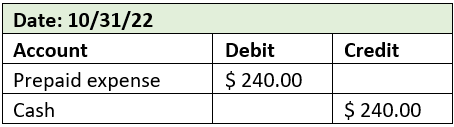

Example: XYZ buys a one-year subscription to host its website. The payment was incurred on 10/31/22 and the price of the subscription for the full year is $240.

Under the cash basis, the entry to record the payment for the website would be as follows:

Under the accrual basis, the entries to record the payment of the annual website subscription and recognize the expense over the period it is incurred would be as follows:

The full expense was incurred on the payment date under the cash basis. Since this subscription lasts for 12 months, the expense should be recorded equally across all 12 months ($240 ÷ 12 months = $20 expense each month) under the accrual basis. At the end of 12 months, the full expense will have been recognized and the prepaid expense of $240 that was booked will be fully amortized and will show as $0 on the balance sheet.

Unearned Revenues

The concept of recording unearned revenue is similar to that of prepaid expenses. Unearned revenues are recorded when cash is received for services that have not yet been performed or for goods that have not yet been provided to the customer. Unearned revenues are not required to be recorded under the cash basis of accounting because the revenue would be recognized when the cash is received regardless of when it was earned.

Example: XYZ company agrees to perform monthly consulting services for ABC company for the calendar year 2022. The consulting services are $500 per month, but ABC decides to pay for the entire year before any work is performed. They make the payment on 1/1/23.

Under the cash basis of accounting, the entry would be recorded as follows:

Under the accrual basis of accounting, the entries would be recorded as follows:

Which is better for you?

- If your goals are to sell the business or obtain business financing, accrual accounting may make it easier for you to reach that goal.

- If your goal is to lower your tax bill, generally it will be more advantageous to file using the cash basis of accounting.

Be sure to communicate these goals with your tax preparer to assure that you are setting yourself up correctly to achieve these goals.

If you have any questions about what is in this article and how it pertains to your business, send an email to jonathan@bullseyebookkeepingllc.com.